In today’s competitive job market, internships are no longer just an extra activity; they have become a must-have for anyone looking to build a successful career. For college students and…

How to Calculate Salary Structure for Freshers – Format & Breakup Calculations

For fresh graduates joining the workforce, understanding how to calculate salary structure is essential. Employee pay and the elements that make up their overall remuneration are determined by the salary structure. This extensive guide seeks to offer thorough explanations of how to calculate the salary structure for freshers. The idea of Cost to Company (CTC) and its elements, how to calculate in-hand salary, the usual Indian salary structure, and numerous formulae used to compute CTC will all be covered.

Freshers may more successfully negotiate salaries, arrange their budget, and comprehend their compensation package by understanding these ideas.

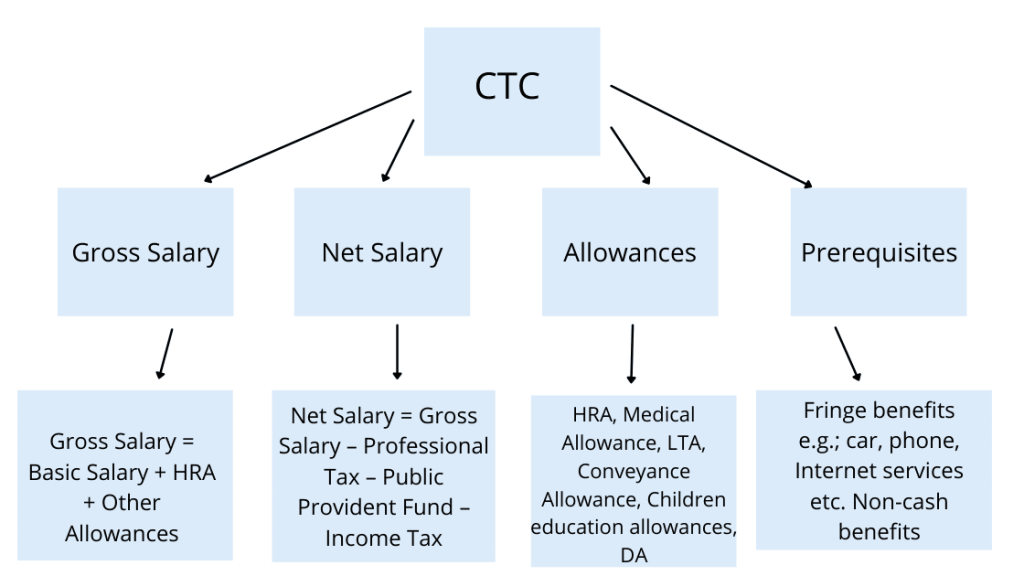

What is CTC?

CTC stands for Cost-to-Comapny. Cost to Company (CTC) refers to the total expenditure an employer incurs in employing a person, including the direct salary and other components. Various components make up the CTC structure.

CTC = Earnings + Deductions

The components of CTC vary depending on the company and the role. However, some standard components include:

- Basic Salary: It is the fixed component of the salary and forms the foundation for calculating various benefits and deductions.

- Allowances: These include House Rent Allowance (HRA), Dearness Allowance (DA), Transport Allowance, and Medical Allowance, among others.

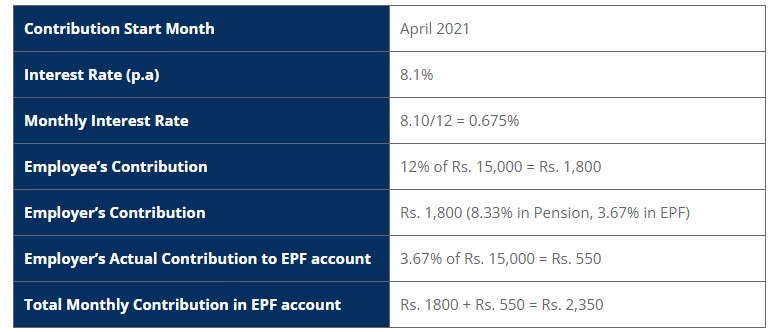

- Statutory Deductions: These deductions comprise Employee Provident Fund (EPF), Professional Tax (PT), and Income Tax (TDS).

- Income tax: This is a tax that is paid on your income.

- Employee Provident Fund (EPF): This is a retirement savings plan that is mandatory for most employees in India.

- Employee State Insurance (ESI): This is a health insurance plan that is mandatory for most employees in India.

- Bonuses and Incentives: Performance-based bonuses, annual bonuses, and incentives are additional components of the CTC.

- Gratuity: The remuneration that you could get from your company after quitting your position includes gratuity. The Payment of Gratuity Act of 1972 regulates its payment. You must satisfy certain requirements in order to get gratuity, such as being qualified for superannuation, having retired from one job, having resigned after five years with the firm, or in the event of your death, disability, illness, or accident. This amount gets deducted every year from the CTC.

Types of Allowances

Some common types of allowances have been listed below which are listed in always listed in a CTC Structure:

- HRA or House Rent Allowance: It is a major salary component paid to an employee to meet accommodation expenses.

- Leave Travel Allowance (LTA): LTA is an amount paid to cover domestic travel expenses. It may not include food and accommodation expenses during the course of the travel.

- Conveyance Allowance: The amount paid to an employee to meet travel expenses incurred while traveling to and from work.

- Dearness Allowance: DA is a living allowance paid to employees to tackle the effects of inflation. This allowance is applicable to government employees, public sector employees, and pensioners. Private sector employees are not eligible for dearness allowance.

- Benefits: These are non-monetary benefits, such as health insurance, retirement plans, and paid leave.

- Other allowances covered in CTC are the special allowance, medical allowances, incentives, etc. Each has a purpose to serve as each helps the employee bear a certain type of expense.

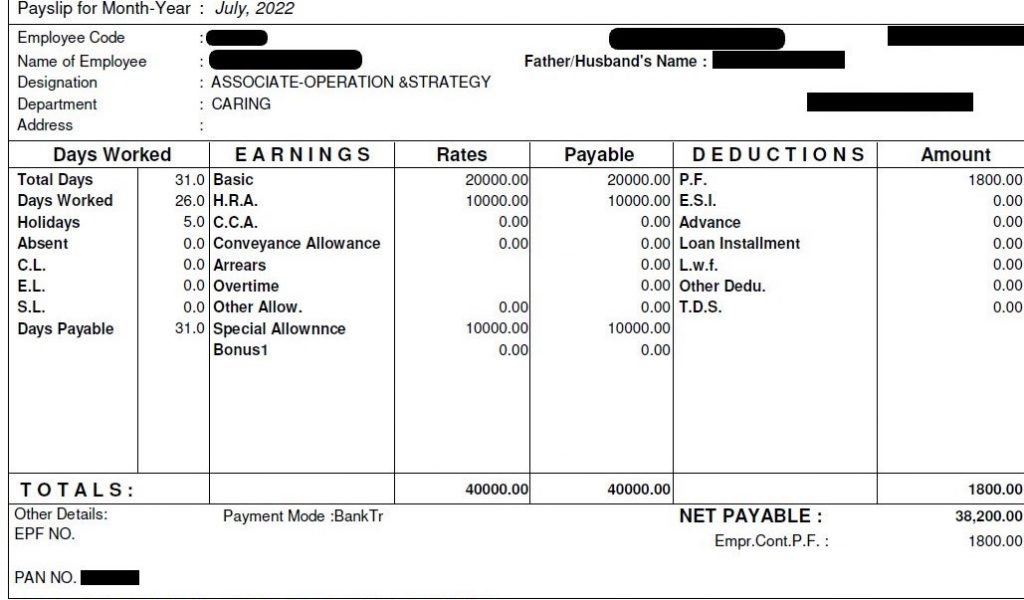

How to Calculate In-Hand Salary?

In-hand salary is the amount of money that you actually receive each month after taxes and deductions have been taken out. To calculate your in-hand salary, you will need to know your CTC and the deductions that will be made from your salary. The deductions will vary depending on the company and the role.

In-hand salary = CTC – (income tax + EPF + ESI)

However, some standard deductions include:

- Gross Salary: Start by calculating the gross salary, which is the total earnings before any deductions.

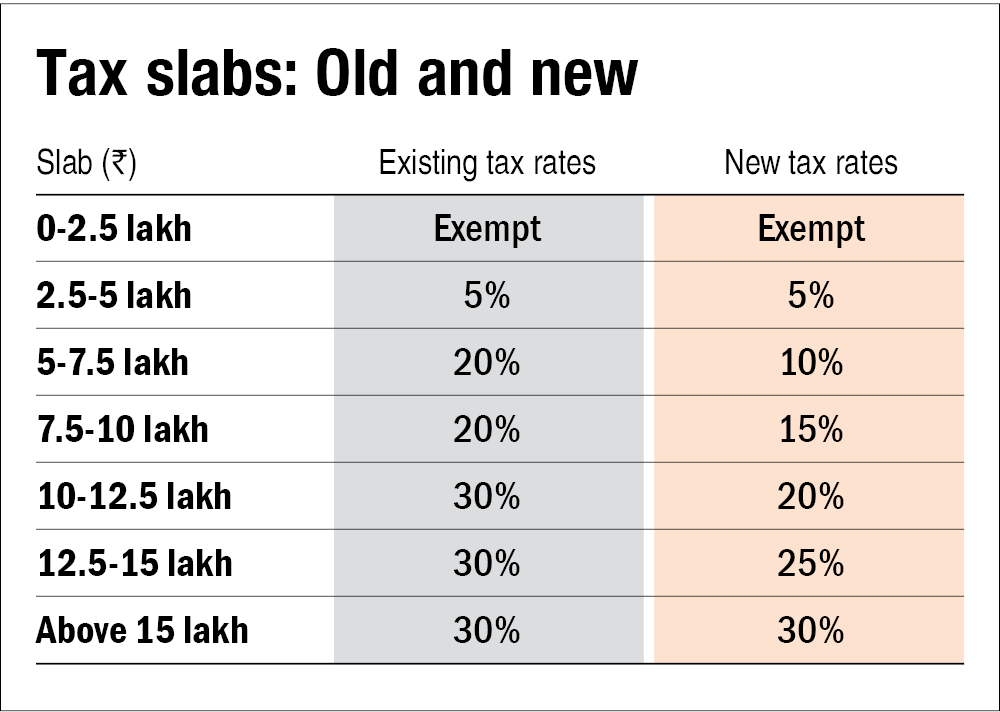

- Deductions: Subtract the statutory deductions like EPF, PT, and TDS from the gross salary to determine the taxable income.

- Income Tax Calculation: Use the applicable income tax slabs and deductions to calculate the income tax liability.

- Net Salary: Subtract the income tax liability and any other voluntary deductions like insurance premiums or loan repayments from the taxable income to arrive at the net salary or in-hand salary.

Net Salary = Gross Salary – Income Tax – PF – Professional Tax

Net Salary is usually lower than gross Salary. In case the tax is 0 as per the government’s tax slabs and there is no PF contribution, net salary becomes equal to gross salary.

What is the Salary Structure in India?

The salary structure in India varies depending on the company and the role. However, there are some common elements that are found in most salary structures.

These elements include:

- Grade: This is the level of the position within the company.

- Band: This is the range of salaries for a particular grade.

- Increment: This is the amount of salary that is typically increased each year.

- Bonus: This is a discretionary payment that is typically paid once a year.

- Allowances: These are payments that are made to cover specific expenses, such as housing, transport, and food.

- Benefits: These are non-monetary benefits, such as health insurance, retirement plans, and paid leave.

Here is an example of a salary structure for a fresher in India:

- Grade: Entry-level

- Band: 4

- Basic salary: INR 25,000

- Bonus: 10% of basic salary

- Allowances:

- Housing allowance: INR 5,000

- Transport allowance: INR 2,000

- Food allowance: INR 1,000

- Benefits:

- Health insurance

- Retirement plan

- 20 paid leaves per year

Salary Structure Calculations: Different formulas to calculate CTC

There are a number of different formulas that can be used to calculate CTC. The most common formula is

CTC = Basic salary + Bonus + Commission + Allowances + Benefits

However, there are other formulas that can be used, depending on the specific circumstances. For example,

- Traditional Approach: Basic Salary + Dearness Allowance + House Rent Allowance + Conveyance Allowance + Medical Allowance + Other Allowances + Bonuses and Incentives – Statutory Deductions = CTC

- Cost-to-Company Approach: Gross Salary + Cost of Benefits and Perquisites – Statutory Deductions = CTC

- Compensation Mix Approach: Combines fixed and variable components based on the organization’s compensation philosophy. It involves assigning weights to different elements, such as basic salary, allowances, and bonuses, to determine the CTC.

What is CTC in Salary?

CTC (Cost to Company) represents the total annual financial commitment an employer makes to an employee, including base salary, bonuses, allowances, insurance benefits, and retirement contributions. It’s the complete compensation package rather than just the take-home salary.

Companies often use CTC in job offers to showcase total benefits. CTCs are more than just the take-home salary and include multiple components:

Fixed Components (50-60% of CTC):

- Basic Salary (40-50% of fixed component)

- House Rent Allowance (HRA)

- Standard Allowances (transport, medical, etc.)

- Special Allowances

Variable Components:

- Performance Bonuses

- Sales Incentives

- Stock Options (ESOPs)

Benefits & Contributions:

- Provident Fund (PF)

- Gratuity

- Health Insurance

- Life Insurance

- Leave Benefits

- Meal Cards

For fresh hires to grasp their overall remuneration and make wise financial decisions, salary structure calculation is essential. Freshers may assess job offers, successfully negotiate, and manage their finances by learning the components of CTC, calculating the in-hand salary, and appreciating the salary structure in India.

Additionally, being familiar with the different CTC calculation techniques enables freshers to understand how their pay is calculated. Research industry norms, emphasize your worth during negotiations, and take the total salary package into account. By adhering to these rules, freshers may successfully navigate the wage calculation process and make decisions about their careers and financial security.

FAQs on Salary Structure for Freshers

How do I calculate my in-hand salary?

To calculate your in-hand salary, keep the following formulae handy:

- In-hand Salary = Gross Salary – Income Tax – Employee’s PF Contribution(PF) – Prof. Tax.

- Gross Salary = Cost to Company (CTC) – Employer’s PF Contribution (EPF) – Gratuity.

- Gratuity = (Basic salary + Dearness allowance) × 15/26 × No. of Years of Service.

How to find the basic salary from CTC?

Typically, the basic pay is 40% of gross income or 50% of CTC. Basic pay is calculated as gross pay minus all allowances (such as transportation, HRA, and medical insurance).

Is the cost-to-company and take-home salary different from each other?

Yes, cost-to-company (CTC) and take-home salaries are different from each other. CTC is the total amount that an employer pays to an employee, including salary, benefits, and allowances. Take-home salary is the amount of money that an employee actually receives after taxes and deductions have been taken out. It is important to understand the difference between CTC and take-home salary when negotiating your salary. You should negotiate your salary based on your take-home salary, not your CTC.

How many types of benefits are there in the CTC?

There are 3 types of benefits in the CTC:

- Direct benefits: These are benefits that are paid directly to the employee, such as salary, bonus, and commission.

- Indirect benefits: These are benefits that are provided to the employee, but are not paid directly, such as health insurance, retirement plan, and paid leave.

- Perquisites: These are benefits that are given to the employee in addition to their salary, such as a company car, a club membership, or a mobile phone.

What are CTC components?

The sum of a company’s hiring and retaining expenses is known as the CTC. It covers your salary as well as all of your benefits, including your EPF, HRA, health benefits, gratuities, and other bonuses. CTC may also contain additional perks like meal discounts, low-interest loans, and transportation services.

What is CTC in Salary?

CTC (Cost to Company) is the total annual compensation package offered by employers, combining basic salary, HRA, bonuses, and benefits like insurance and PF. While CTC looks attractive, actual take-home salary is typically 60-70% of CTC after deducting taxes and other components.

Latest Posts

Python vs JavaScript: Which Language Should You Learn First?

Choosing the right programming language can shape your career in today’s competitive tech world. Two of the most popular languages among beginners and professionals are Python and JavaScript. If you’re…

AI Trends Transforming Tech and Businesses in 2025!

Artificial Intelligence (AI) is no longer just a futuristic concept, it’s shaping how we live, work, and think. For college students and freshers in India aspiring to build a career…

Software Development Engineer [SDE] – Full Form, How to Become

Software Development Engineers (SDEs) are the backbone of the technology industry, responsible for crafting innovative software solutions that power our digital world. In this extensive guide, we will delve into…

How to Write a Perfect Career Objective for a Freshers’ Resume

A career objective is a concise statement that summarizes your professional objectives. It usually appears at the top of your resume and can help companies figure out what you’re looking…

Popular Posts

Top 21 Highest Paying Jobs in India For Freshers

The Indian job market is evolving rapidly, with new opportunities emerging across various sectors. As a student or fresher, identifying the best career in India that aligns with your interests…

25+ Best Online Courses for Graduates in 2025 [Free & Certified]

In today’s competitive job market, earning a degree is just the beginning. To truly stand out, college students and freshers must constantly upskill, stay updated with industry trends, and gain…

Best CV Formats for Freshers: Simple, Professional & Job-Winning Templates

Creating an effective CV (Curriculum Vitae) is the first step towards landing your dream job or internship as a fresh graduate. Your CV is your initial introduction to potential employers…

Top Computer Science Jobs for Freshers in India

The rapid evolution of technology has created immense opportunities for fresh computer science graduates. With the IT sector expanding globally, India is one of the top countries offering lucrative and…

How to Answer – ‘What Are Your Strengths and Weaknesses?’

Landing your first job is a thrilling yet daunting experience. You’ve meticulously crafted your resume, researched the company, and prepped for potential questions. But there’s one question that throws even…